Digital transactions and cyber threats are rapidly growing highlighting the need for financial institutions are promote the latest technology to confirm the security and observed operations. Technologies like IRIS recognition are one of the most important and accurate biometric procedures which is useful to check the person depending on distinctive eye’s iris patterns. Let’s discuss how this new relationship between IRIS scan systems and Anti-Money Laundering struggles and how this method increases security and observance.

1. Understanding Iris Recognition and Its Applications

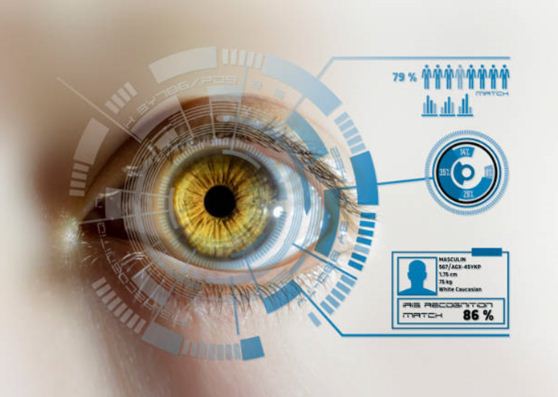

Iris recognition is one of the most essential biometric systems that is useful for the mathematical pattern-recognition methods to recognize a person by checking the distinctive iris characters. The iris remains secure for the person’s entire life that makes the potential candidate for safe identification. This process is different from fingerprints or other facial features and makes the iris recognition method unique. Furthermore, this method also involves retaining the eye image and then converts into a digital format to compare against the stored irises. This system is extremely useful for more than one sector, like border control, healthcare, and financial services which indicates identification is critical.

2. Role of Iris Scanning in Customer Verification

Customer verification methods are one of the most important uses of iris scan technology in the financial sector. Moreover, banks and financial institutions need to stick with Know Your Customer regulations that direct the complete identification and customer verification. Iris verification facilitates highly useful techniques to confirm an individual’s identity and prominently decrease identity fraud risks. Financial organizations can improve protection the of illegal activities, for instance, money laundering and fraud by confirming that customers are real.

3. Enhancing AML Efforts with Iris Biometric Technology

Anti-money laundering mandates are designed in a way to protect against financial crimes by confirming that financial organizations can check and detect doubtful activities. However, the incorporation of iris biometric methods into AML activities empowers all these struggles by facilitating safe and authentic methods of customer identification. This method also assists in checking the transactions and checking the irregular patterns they can show the fraud behavior. Also, the use of iris detection to recognize and check customers enables organizations to more successfully adhere to AML regulations and decrease financial crime risks.

4. Preventing Identity Theft and Fraud

Moreover, identity theft and other fraudulent activities are some of the most important concerns in the financial industry because they lead to extreme financial losses. It also damages the organization’s reputation in the market. Whereas iris recognition provides the best and strongest solutions to these challenges based on the distinctive patterns in the iris which is difficult to duplicate. The execution of iris scan systems enables financial organizations to enhance security measurement and guarantees that only legal persons access sensitive information.

5. Compliance and Regulatory Benefits

Furthermore, the iris verification systems in financial services will not only increase security but also be useful to adhere the regulatory demands. The AML observance usually demands strong customer identification and verification methods. Many financial organizations can fulfill the requirements efficiently by using iris biometric techniques and decreasing the non-compliance risks. So, this method also smoothens the method of balancing the precise records of customer interactivity and transactions.

6. Future Trends and Developments in Iris Recognition

With the technological advancements, the apps of iris recognition will likely expand more. Some innovations in iris detection and research methods can improve the accuracy and success of these systems. Also, this system will be more accessible alongside cost-effectiveness for a huge range of applications. In the AML scenario, the development of iris biometric systems can lead to more experienced checking and reporting tools. It enables the financial organizations to check and protect the doubtful campaigns actively.

Final Thoughts

The incorporation of iris scan systems into AML efforts provides strong and important benefits for various financial organizations. Iris recognition methods assist in protecting against identity theft, along with secure techniques of illegal activities by providing an accurate and safe method for customer identification system. It assists in the observance of regulatory requirements by confirming that organizations can efficiently check and stop doubtful transactions.